KEEP IN TOUCH

Subscribe to our mailing list to get free tips on Data Protection and Cybersecurity updates weekly!

Last month, Mr K. K. (not his real name) thought he was helping the Government in a secret operation to catch hackers.

The permanent resident was led to believe that by transferring $180,000 to a Hong Kong bank account, he could help the authorities track down and nab criminals who had stolen the personal information of many victims.

As it turned out, the senior IT professional had himself fallen prey to a tech support scam.

Speaking to the media on Wednesday, Mr K. K, who is in his 50s, said he was first contacted by a man claiming to be a Singtel employee on Dec 16.

The man, who gave his name as “Alex Murphy”, told Mr K. K. over the phone that his router had been hacked and anyone could connect to his network.

To gain his trust, the scammer told Mr K. K. what his router’s network identification number was.

“He was not pushy and was very calm. I could not sense anything wrong,” said Mr K. K.

Claiming that further investigation was necessary, the scammer told Mr K. K. that another Singtel staff member would contact him shortly.

A second scammer, going by the name of “Paul Thomas”, told Mr K. K. that his work computer had been compromised.

He convinced Mr K. K. to download the monitoring software TeamViewer so he could check external IP addresses, which might lead to the hackers.

Little did Mr K. K. know that once such applications are installed, scammers can remotely access victims’ computers and transfer money out of their bank accounts.

A third scammer, “Eric Lewis”, introduced to Mr K. K. the next day as a “Cyber Police Agency” officer, asked him to sign in to his bank account so that “Eric Lewis” could secure his banking access on the computer.

Unbeknown to him, the scammers had transferred $180,000 from one of his bank accounts to an account he held with OCBC Bank. “Eric Lewis” then claimed that hackers had hijacked his bank account for money laundering purposes.

Mr K. K. was led to believe that by transferring the money to an HSBC bank account in Hong Kong, he would be able to help the agency trace the hackers’ location.

Also Read: A Look at the Risk Assessment Form Singapore Government Requires

When Mr K. K. went to OCBC’s branch in Clementi on Dec 18 to make a telegraphic transfer, a bank employee declined to transfer the sum that Mr K. K. claimed was for family maintenance.

That day, OCBC alerted the Anti-Scam Centre of the case and police officers visited the man’s home to advise him against transferring the money.

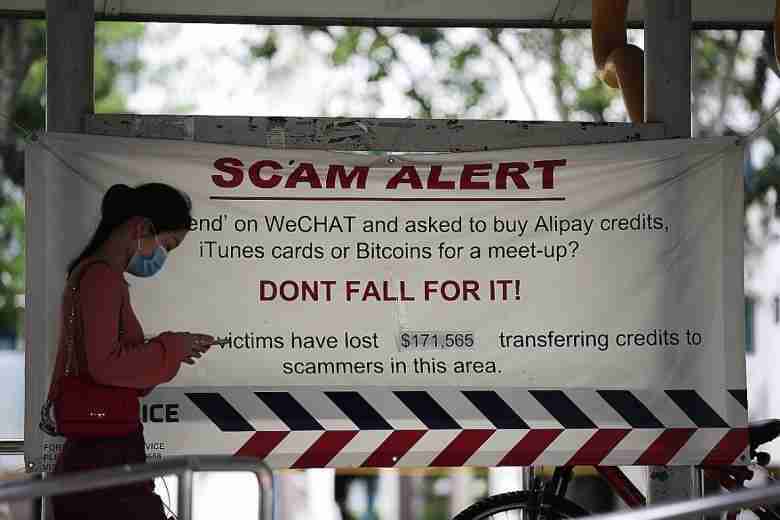

In the first half of last year, there were 313 cases of tech support scams reported to the police – more than 10 times the 30 cases in the same period in 2019.

Victims lost a total of $14.9 million, up from $340,000 in the same period in 2019.

Members of the public can take the following actions if they suspect they have been targeted by scammers:

l Log off and shut down their computers to limit any further actions that the scammers can execute.

l Report the incident to their bank to stop further activities on their bank accounts.

l Change their iBanking credentials and remove any unauthorised payees that may have been added to their bank accounts.

“No telecommunications service provider or government agency will request your personal details or access to your online bank account over the phone,” said the police.

Those who find themselves in such situations can call the official hotline of their telecommunications service provider to verify the facts.

They can also talk to a trusted friend or relative before acting on such instructions.

The public should also refrain from providing their personal details, such as bank account numbers, credit card details and one-time passwords over the phone to unfamiliar or unverified people.